Security-first with

Cut APRs on Your Credit Cards

Never pay above 12% interest again

Only $0.99/m for 3 months then $4.99/m

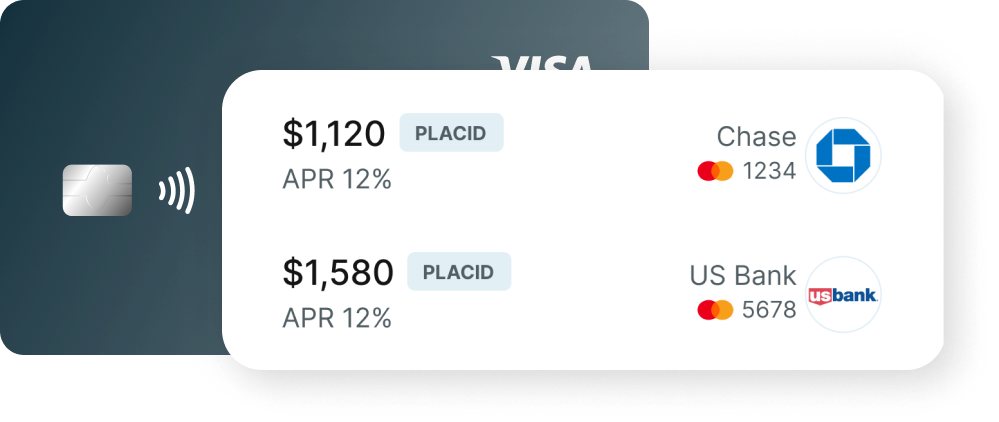

Placid tracks rollover balances on your credit cards and transfers them to a 12% APR credit line from the cards with higher APRs. No balance transfer fees, no late fees, no overdraft fees, no tricks. Join to save hundreds of dollars on interest every month, payoff balances faster, and enjoy card perks stress-free.

FICO 660+ and good credit standing required. Not a debt consolidation service.

4,9

★★★★★

Easily save on interest

Placid automatically transfers any rolling balance from all your cards to a low APR credit line. Just keep using your cards and watch your savings grow.

Your minimum card payments go down with Placid. You can pay less for your cards every month and still pay them off faster, because less interest is charged and more balance is paid off.

Pay less, payoff faster

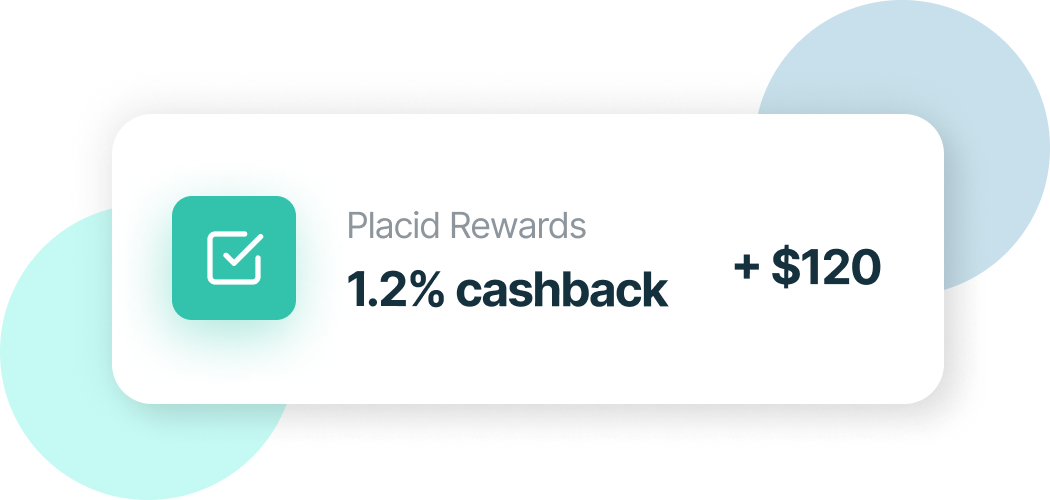

Get payoff rewards

Placid tops up your account with 0.1% of your Placid balance every month when you repay on time.

Placid can automatically payoff balances and card bills for you. You pay just one bill a month for all your cards and watch your savings grow and card balances go down.

Get it all covered

Your data is safe

Placid meets the highest security and privacy standards of the banking industry.

Your data safety is our top priority. Placid uses the strongest encryption and anonymization whenever possible.

Your data safety is our top priority. Placid uses the strongest encryption and anonymization whenever possible.

Autopay your card bills out of Placid pocket. First $500 are interest-free and only 12% APR if you need more! Repay Placid later 14 to 45 days later. You'll never hit a late payment or an overdraft fee.

Watch

your cards

auto paid

your cards

auto paid

Get

started

in 3 minutes

started

in 3 minutes

How it Works

Download the app, securely connect your cards and get a 12% APR credit line ready to offload your expensive balances. Placid instantly checks your eligibility with a soft credit pull that doesn't affect your credit score.

Track

and adjust

your progress

and adjust

your progress

Set how much to pay above minimum payments every month and track your accelerated payoff and interest savings. Watch you savings grow without you spending more.

Who is Placid good for?

If you actively use credit cards or roll credit card balance, Placid is for you. Placid is great at making your credit cards cheaper and hassle-free.

Is using Placid safe?

Placid meets the highest security and privacy standards of the banking industry. We use the strongest encryption and anonymize data whenever possible.

Does Placid affect my credit score?

In most cases, Placid improves your credit score. We prevent late payments and reduce the amount of debt on your cards, which has a great positive effect on the score. You can improve the score further by paying on time to Placid.

We don't charge any fees If you're late with payments to Placid, but your credit score will be negatively affected.

We don't charge any fees If you're late with payments to Placid, but your credit score will be negatively affected.

What are the requirements to use Placid?

Placid runs a soft credit check to verify you're in good standing and open a credit line for you. Typically FICO 660 and above would be needed to pass the check.

How does Placid make money?

Placid charges 12% interest rate on balances transferred to Placid from your cards. Placid transfers only expensive balances, so that you always save money.**

Why should I invest the money I save on interest?

Card debt tends to come back even after a full payoff. Credit cards is a lucrative business for banks for a reason.

Sufficient savings and investments lower the chances of getting into debt again. They improve financial stability and reduce the stress of debt. But they also take time and resources to build.

Placid helps build your investments without any extra spending or changes to how spend and use your cards. We make balancing between payoff and savings easy and help you seamlessly build wealth over time with regular investments.

Sufficient savings and investments lower the chances of getting into debt again. They improve financial stability and reduce the stress of debt. But they also take time and resources to build.

Placid helps build your investments without any extra spending or changes to how spend and use your cards. We make balancing between payoff and savings easy and help you seamlessly build wealth over time with regular investments.

Is Placid a bank?

No, Placid is a technology company and a money lender. We provide our customers with tools and capital to make credit cards cheaper and more convenient.

Placid is run by a team of veterans from global banks and world-class software engineers. We are on a mission to help people use debt to become better off financially.

Placid is run by a team of veterans from global banks and world-class software engineers. We are on a mission to help people use debt to become better off financially.

Join Placid

Lower APRs on your credit cards

I agree that Placid will inform me by e-mail about financial products and services. My data will be used exclusively for this purpose.

* 0% APR is applied to up to $500 that is used for paying monthly payments or reducing card utilizations. The number of extra days to pay off varies from 14 to 45, depending on the due dates of connected cards. Larger credit amounts and rolling payoff terms require additional user qualification.

** Actual savings depend on user's card APRs. Placid credit line APR (which is the same as interest rate) for balance transfers is 12%.

If user's APR is 34%, total balance is $10,000 and fixed monthly payments are $384, user's interest expense until full payoff would be $8,401 vs. $1,642 with Placid, which is 80.5% less. If user's APR is 24%, total balance is $10,000 and fixed monthly payments are $300, user's interest expense until full payoff would be $6,644 vs. $2,225 with Placid, which is 66.5% less.

https://www.bankrate.com/calculators/managing-debt/minimum-payment-calculator.aspx

† Placid tops up your rewards account with 0.1% of the balance you have with Placid every time you pay your Placid Bill on time. You can use your rewards freely at any time, including using them to reduce your Placid Bill.

Placid Inc.

+1 332 228 0020

160 East 65th street, New York, NY, US, 10065

Copyright 2021. All rights reserved.

** Actual savings depend on user's card APRs. Placid credit line APR (which is the same as interest rate) for balance transfers is 12%.

If user's APR is 34%, total balance is $10,000 and fixed monthly payments are $384, user's interest expense until full payoff would be $8,401 vs. $1,642 with Placid, which is 80.5% less. If user's APR is 24%, total balance is $10,000 and fixed monthly payments are $300, user's interest expense until full payoff would be $6,644 vs. $2,225 with Placid, which is 66.5% less.

https://www.bankrate.com/calculators/managing-debt/minimum-payment-calculator.aspx

† Placid tops up your rewards account with 0.1% of the balance you have with Placid every time you pay your Placid Bill on time. You can use your rewards freely at any time, including using them to reduce your Placid Bill.

Placid Inc.

+1 332 228 0020

160 East 65th street, New York, NY, US, 10065

Copyright 2021. All rights reserved.