Turn your credit card expenses into cash savings

Connect your cards to a low interest credit line. Pay off card balances automatically, cut interest and fees and grow the cash you save.

Bank-level security

No credit score cutoff

Real cash savings

Move expensive balances to your personal low interest credit line.

Prevent late payment and over-the-limit fees on any card.

Get a no fee, low interest cash advance to any card.

Connect your credit line to a debit card you like and save on annual credit card fees.

Prevent late payment and over-the-limit fees on any card.

Get a no fee, low interest cash advance to any card.

Connect your credit line to a debit card you like and save on annual credit card fees.

Pay 2x less for your credit cards

Automatically deposit what you save on interest and fees from the card payments you make.

Use your FDIC-insured deposit any way you like.

Get cash rewards for paying off debt and staying on track.

Get cash rewards when your support circle - people with similar financial goals - stays on track.

Invest from your deposit into stocks, directly or through retirement plans, commission-free.

Use your FDIC-insured deposit any way you like.

Get cash rewards for paying off debt and staying on track.

Get cash rewards when your support circle - people with similar financial goals - stays on track.

Invest from your deposit into stocks, directly or through retirement plans, commission-free.

Save cash while paying off debt

Balance

Monthly payment

Interest

paid

paid

Now

Placid

$10,000

$300

$6,644

$10,000

$300

$3,000

Placid would deposit $60 out of every payment and pay the rest to the credit card. Cash rewards are granted in absence of late payments in a form of 1.5% cashback.

https://www.bankrate.com/calculators/managing-debt/minimum-payment-calculator.aspx

https://www.bankrate.com/calculators/managing-debt/minimum-payment-calculator.aspx

Pay off months

56

55

APR

24%

12%

Pay off rewards

$0

$672

Cash

deposit

deposit

$0

$3,972

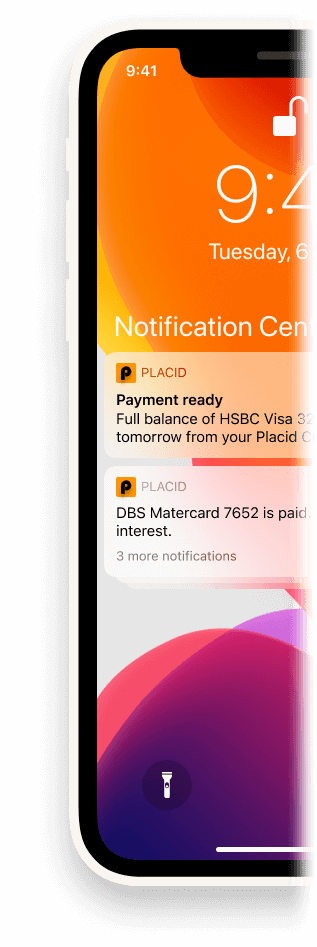

Get a clear picture of all balances and how they change.

Pay for all cards with a single monthly payment on the day you choose.

Automatically optimize payment and savings amounts to reach your goals faster.

Choose to pay a fixed flat monthly fee or equivalent variable payments.

Track and improve your credit score with lower card balances and no late payments.

Pay for all cards with a single monthly payment on the day you choose.

Automatically optimize payment and savings amounts to reach your goals faster.

Choose to pay a fixed flat monthly fee or equivalent variable payments.

Track and improve your credit score with lower card balances and no late payments.

Easily mange debt

Download Placid app and connect your cards and accounts through your online bank. It's completely secure.

Add cards and accounts

Activate your credit line

Apply for a credit line from the app. We'll ask you for an ID to present. No paperwork needed.

Check the auto setup

Check, adjust and approve suggested payment amounts and schedules.

1

2

3

How it works

Watch your savings grow

Keep using cards as usual and celebrate your savings going up and card balances going down.

4

Is Placid a bank?

Placid is a technology company and a government-licensed money lender. We provide our customers with tools and capital to make credit cards cheaper and more convenient.

Placid is conceived and run by a team of retail banking veterans from global banks like Citi, HSBS and Nordea, and world class software engineers. We are on a mission to make credit more fair - make it cheaper for those who need it most and help people leverage it to become better off financially.

Our goal with Placid is to help you grow savings and investments while reducing your card debt. This goal is supported by our business model - we only make money when you save money, and because of that we hope that once you're debt-free, you'll stay with us and keep using our products that will help you save and earn even more.

That's why Placid is completely on your side - the more you save, the happier we are. To support you even further we've innovated a way to reward you for responsible debt servicing and staying on track to your financial goals.

Placid is conceived and run by a team of retail banking veterans from global banks like Citi, HSBS and Nordea, and world class software engineers. We are on a mission to make credit more fair - make it cheaper for those who need it most and help people leverage it to become better off financially.

Our goal with Placid is to help you grow savings and investments while reducing your card debt. This goal is supported by our business model - we only make money when you save money, and because of that we hope that once you're debt-free, you'll stay with us and keep using our products that will help you save and earn even more.

That's why Placid is completely on your side - the more you save, the happier we are. To support you even further we've innovated a way to reward you for responsible debt servicing and staying on track to your financial goals.

How does Placid make money?

When you use Placid credit line, Placid charges interest on the amount of credit provided. The interest rates are personalized and are significantly less than the rates on some of your cards. You always save money when using Placid, and we make some money too.

As you progress with debt pay off, your cash savings grow, and Placid helps you manage them - invest, accumulate for specific goals and spend smarter. Placid is paid by our bank partners for managing your savings, and that's why Placid benefits from you having more savings and less debt and is genuinely interested in helping you keep the debt levels healthy.

Paying for Placid means paying interest on the Placid credit line. You do that once a month with a single payment, that is also used to pay for the cards you've chosen to cover by Placid. Payments can be made from any of your checking or savings accounts and can be fully automated at your discretion.

As you progress with debt pay off, your cash savings grow, and Placid helps you manage them - invest, accumulate for specific goals and spend smarter. Placid is paid by our bank partners for managing your savings, and that's why Placid benefits from you having more savings and less debt and is genuinely interested in helping you keep the debt levels healthy.

Paying for Placid means paying interest on the Placid credit line. You do that once a month with a single payment, that is also used to pay for the cards you've chosen to cover by Placid. Payments can be made from any of your checking or savings accounts and can be fully automated at your discretion.

Is using Placid safe?

We follow and surpass the highest security and privacy standards of the banking industry. We used the strongest encryption for all your data and anonymize it whenever possible, so that even security breaches or fraudulent activities will not affect your data privacy. We are audited independently and report to the government regulator on a regular basis to confirm us meeting the standards.

We guarantee full compensation for any errors and associated expenses in the highly unlikely scenario they occur when using Placid.

We guarantee full compensation for any errors and associated expenses in the highly unlikely scenario they occur when using Placid.

Does Placid affect my credit score?

In most cases, Placid improves your credit score. We prevent late payments and reduce the amount of debt on your cards, which has a great positive effect on the score. You can improve the score further with no late payments on the Placid credit line.

If you're late with payments to Placid, we won't charge late fees, but your credit score will be negatively affected.

If you're late with payments to Placid, we won't charge late fees, but your credit score will be negatively affected.

Who is Placid good for?

If you you pay interest on your credit cards occasionally or regularly - Placid is for you! Placid is great at making your credit cards much cheaper and hassle-free. It will help you with debt consolidation, refinancing, fees prevention, paying off debt faster, automating card payments, and, most importantly, growing your real savings.

There are no pre-requisites to using Placid - no minimum credit score, card balance or other constrains.

There are no pre-requisites to using Placid - no minimum credit score, card balance or other constrains.

Why would I choose Placid over a balance transfer?

There's a number of barriers that can make balance transfer inconvenient and costly. Often times there's a significant balance transfer fee, a limit to how much debt can be transferred, a hassle of getting and using a new credit card, and a cost of loosing some perks on the old card.

But more importantly, balance transfers increase the risk of loosing control over your debt. Lower promotional interest rates can false you into a sense of relief, leading to accumulating more debt, that will eventually become as expensive as the old one or even more. You will have to stay alert to not miss that moment and do another balance transfer before that happens.

Placid on the other hand is all about growing your savings and bringing you peace of mind, transparency and full control. Our mission is to get you out of debt as smoothly and cheaply as possible.

But more importantly, balance transfers increase the risk of loosing control over your debt. Lower promotional interest rates can false you into a sense of relief, leading to accumulating more debt, that will eventually become as expensive as the old one or even more. You will have to stay alert to not miss that moment and do another balance transfer before that happens.

Placid on the other hand is all about growing your savings and bringing you peace of mind, transparency and full control. Our mission is to get you out of debt as smoothly and cheaply as possible.

I agree that Placid will inform me by e-mail about financial products and services. My data will be used exclusively for this purpose. It will not be passed on to third parties. I can revoke my consent at any time by using the unsubscribe link contained in the e-mails. You will find detailed information about the newsletter in our privacy policy.

Get an exclusive access to our launch

early next year

early next year

Reserve your Placid